The federal income tax system in this country is progressive. Comparison of tax rates around the world is a difficult and somewhat subjective enterprise.

Tax Revenues Where Does The Money Come From And What Are The Next Government S Challenges Institute For Fiscal Studies Ifs

Tax Revenues Where Does The Money Come From And What Are The Next Government S Challenges Institute For Fiscal Studies Ifs

Income Tax is a tax you pay on your income.

What is income tax used for. Federal income tax is used for a variety of expenses ranging from building and repairing the countrys infrastructure to improving education and public transportation and providing disaster relief. Your gross income is the sum of all the money you. Tax code is quite complex so its no wonder many Americans dont know how their income tax is determined.

Income from a trust. The tax systems vary greatly and can be progressive proportional or regressive depending on the type of tax. The IRS has tax brackets tied to income.

Income tax is a tax levied directly on personal income. This guide is also available in Welsh Cymraeg. How taxes are used depends on which level of government is collecting them.

Money you earn from. It collects taxes and then disburses them according to the budget agreed upon by both chambers of Congress and the President. How much Income Tax will I pay.

Income taxes are used in most countries around the world. To put it simply income tax is the tax on your earnings. So if you fall into the 22 tax bracket a 1000 deduction could save you 220.

Voluntary reporting of income tax. Taxes are levied in almost every country of the world primarily to raise revenue for government expenditures although they serve other purposes as well. Income Tax is undoubtedly the most important source of revenue for the Indian government.

For corporation tax purposes the Schedular system was repealed and superseded by the Corporation Tax Acts of 2009 and 2010. Federal taxes are used for such major outlays as national defense Social Security and health care and interest on the national debt. When calculating the amount of federal income tax you owe the IRS goes through.

Income Tax is collected by HMRC on behalf of the government. The more you make the higher your tax bracket and the greater the percentage of your income thats taxed. Since tax season is upon us you may be wondering what you owe or will earn this year in taxes.

There is no age limit for deducting income tax and there is no employer contribution required. State and local taxes are used primarily for education transportation and law enforcement. Your AGI or adjusted gross income is the amount calculated from your total income the IRS uses to determine how much the government can tax you.

Personal income tax is a type of income tax that is levied on an individuals wages. The federal government relies on each taxpayer to voluntarily report all of their income on a tax return and calculate the appropriate tax using current tax laws. The highest rate of income tax peaked in the Second World War at 9925.

Once your earnings go above your personal allowance you must pay tax on the following sources of income. Taxation imposition of compulsory levies on individuals or entities by governments. Generally deductions lower your taxable income by the percentage of your highest federal income tax bracket.

Federal income taxes are used to pay for virtually anything under the sun. For income tax purposes the remaining schedules were superseded by the Income Tax Trading and Other Income Act 2005 which also repealed Schedule F. Its used to help provide funding for public services such as the NHS education and the welfare system as well as investment in public projects such as roads rail and housing.

You do not have to pay tax on all types of income. Taxable income is the base number used to calculate how much an individual or company owes the government in taxes for a given tax year. You pay tax on things like.

Income tax is used to fund public services pay government obligations and provide goods for citizens. As an employer or payer you are responsible for deducting income tax from the remuneration or other income you pay. Progressive in tax lingo means that people with more money pay a higher proportion in taxes.

Income tax system is a voluntary system. Each year the federal government must fund billions of dollars worth of programs and does so through federal income taxes. It is established as an inevitable imposition on the citizens in order to raise funds for fulfilling the development defence needs of the country.

However this doesnt mean paying income tax is optional. Tax laws in most countries are extremely complex and tax burden falls differently.

Who Doesn T Pay Taxes In Eight Charts The Washington Post

Who Doesn T Pay Taxes In Eight Charts The Washington Post

What Is Tax Types Of Tax Benefits And Penalty In Tax

What Is Tax Types Of Tax Benefits And Penalty In Tax

Revenue Wisconsin Budget Project

Benefits Of Filing Income Tax Return On Time Avoid Penalties Other Benefits

Benefits Of Filing Income Tax Return On Time Avoid Penalties Other Benefits

What Is Federal Income Tax Used For Lovetoknow

What Is Federal Income Tax Used For Lovetoknow

Income Tax In The United States Wikipedia

Income Tax In The United States Wikipedia

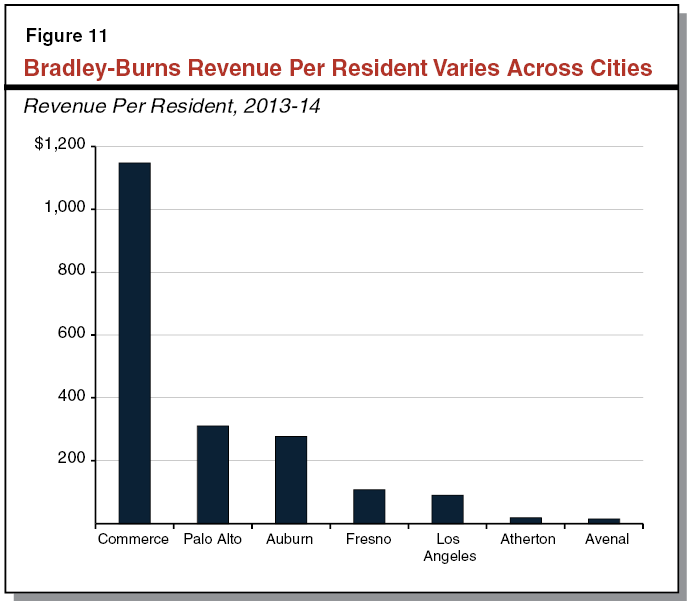

Understanding California S Sales Tax

Understanding California S Sales Tax

Are Federal Taxes Progressive Tax Policy Center

Are Federal Taxes Progressive Tax Policy Center

What Are The Sources Of Revenue For The Federal Government Tax Policy Center

What Are The Sources Of Revenue For The Federal Government Tax Policy Center